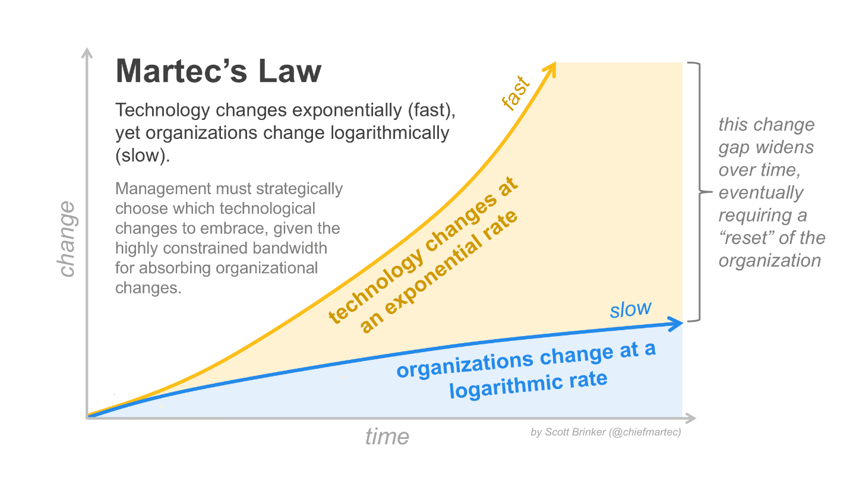

The rate of technological development has become exponential. The evidence is all around us.

If someone from the 7th century was dropped into the 10th century he might not even be able to tell the difference. However, the world of 2017 would seem bizarre to someone even from the 1940s.

Unfortunately, the rate of adoption of these changes, especially by large, lumbering corporations is nowhere at fast. This is what Martec’s Law postulates. As time goes on, the gap between technological advancement and its adoption keeps increasing – this gap is the disruption. Eventually, the gap can become big enough to cause organizations to falter and even fail completely. The vacuum thus created is filled in by new players, who start higher up on the technological graph and can thus cope much better. This cycle of life for companies and thus for entire industries might not be necessarily bad. However, it does impact those who are stakeholders in the company – employees, customers, shareholders, vendors and so on.

The financial services industry has always been quick at adopting new technologies which provides it an edge and improves its efficiency. For example, telecommunication technology, computing power, data storage/ retrieval and statistical techniques have been used extensively by banks and insurance companies.

But what are the trends of the future and can the current players survive the ongoing disruption in the financial services industry?

Decentralization

The most powerful and potential disrupting trend would have to be the decentralization of service and product delivery in the financial services industry. The core business of a bank is to essentially take deposits, assess risk and make loans – these activities are being threatened by decentralized peer to peer lending platforms which assess risks and make loans. Many customers now keep their money in digital wallets rather than traditional bank accounts. Thousands of payment gateways and payment processors have taken over the business of financial transactions and cash management. Banks still play a role, but they are no longer at the core.

The decentralization trend is not just limited to core banking either. Private equity and venture capital firms once provided a lot of the high risk capital for innovative new companies. Now, it is possible to bypass them and access capital directly from the masses using crowdfunding. Games, vehicles, electronics, social projects, gadgets etc. have all been successfully funded using crowdfunding and it’s one of the fastest growing sources of alternate funding.

How The near future

So what does the future look like? Some analysts believe that some of these trends might just turn out to be a temporary fad. For example, if a few of the large crowdfunded projects turn out to be duds, the general population might lose their appetite for such investments.

The fact of the matter is that it does not matter if one or two trends fail – overall the industry will keeping moving towards decentralization. The lessons of the 2008 crisis and the “too big to fail” effect has also convinced many governments on the need to reduce regulation and allow more smaller players to jump in. So how will corporate/ retail banking, insurance, trading, investments, payment processing etc. look like in 2025? We dive into more details in Part 2.

References

- Read more articles on FinTechs in VentureSkies' blog section.

- Read more on the services and packaged solutions which VentureSkies offers for FinTechs.

- PSD2 Directive - DIRECTIVE (EU) 2015/2366 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 25 November 2015 on payment services in the internal market, amending Directives 2002/65/EC, 2009/110/EC and 2013/36/EU and Regulation (EU) No 1093/2010, and repealing Directive 2007/64/EC (2015), The European Parliament and the Council of the European Union.

- DIRECTIVE 2007/64/EC OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 13 November 2007 on payment services in the internal market amending Directives 97/7/EC, 2002/65/EC, 2005/60/EC and 2006/48/EC and repealing Directive 97/5/EC (2007), The European Parliament and the Council of the European Union.

Credits

- Image "pictures-of-money" courtesy of Communities Creating Opportunity, Flickr (License: CC by 2.0)